How to calculate the cost of customer acquisition

This post explains how to calculate the cost of customer acquisition. Knowing the customer acquisition cost is a key actionable metric for your business and understanding how effective your marketing is at attracting new customers.

As a small business owner you need to attract more customers in order to grow your business. You grow your business by adding new customers. Customer acquisition is simply the process of attracting those customers.

To attract and acquire those customers first you need to persuade them to buy from you, which forms the basis of your customer acquisition plan.

What is Customer Acquisition Cost?

So, Customer Acquisition Cost (CAC) is the cost of attracting those new customers.

In the days before the internet business owners would have taken an advert out in the press, aired a radio ad or maybe taken a tv advertising slot and shown a commercial. However, with the rise of the internet, customer acquisition has expanded to include web based adverts such as pay per click (PPC) and display adverts (Cost per impression – CPM).

Consequently when you’re paying for your ads based on the clicks or the number of time your ad appears, you want to be certain that the ads are paying for themselves pretty quickly. It’s no surprise that Customer Acquisition Cost has been embraced as a key actionable metric for internet based businesses.

So Customer Acquisition Cost is the metric you use to understand the effectiveness of your marketing.

If you can the reduce the costs of attracting new customers, but still attract the new customers, in other other words, if you attract more customers for less money, then quite simply you as the business owner will increase profits and make more money.

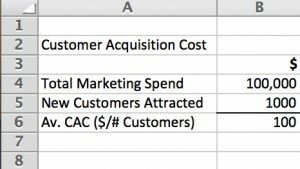

How to calculate customer acquisition cost

The customer acquisition cost (CAC) is calculated by adding together all of the costs spent on acquiring new customers – the marketing expenses (e.g design, web development, SEO, advertising, etc) and then dividing it by the number of new customers that you are able to attract in the period that you’re monitoring. (e.g. Day, week, month, year).

For example if you spent $1,000 a month on marketing and advertising expenses and you attracted 10 new customers, then your customer acquisition cost would be:

Customer Acquisition Cost = $1,000 / 10 = $100 per new customer.

The simplest approach is create a spreadsheet and take all your receipts and bundle them up into week, quarter, month, year (or whatever period you want to analyse) then add all your receipts and divide it by the number of new customers you’ve acquired in the same period.

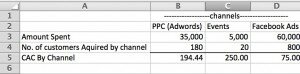

How to calculate customer acquisition cost by marketing channel

A customer acquisition cost by marketing channel is essentially the cost of acquiring customers by each marketing channel that you use. For example, say you advertise using Google Adwords, Facebook ads and events then you can take out your spreadsheet again and add up all your costs against each of these marketing channels. Then divide the number of new customers acquired via those channels by the marketing cost for the acquiring them and you then have the customer acquisition cost by marketing channel.

How to use the customer acquisition cost

Over time, the customer acquisition cost (CAC) will change. It will change depending on what marketing activity you’ve been doing and how potential customers respond to your marketing.

In other words, over time, your marketing will become less effective which is why you need to change your offers when it starts becoming less effective..

Consequently when you see that the Customer Acquisition Cost is increasing, then it’s a good early indicator that the acquisition process might need attention as it’s becoming less effective.

To be truly meaningful for you, the Customer Acquisition Cost should be compared with the Customer Lifetime Value (CLV). The Customer Lifetime Value is simply the average value of a customer over the period you do business with them (i.e. the life of the relationship).

How to improve customer acquisition cost

When you know your customer acquisition cost, you can set about improving it. i.e. reducing it. There’s several things that you can look to do to improve your customer acquisition cost:

- improve your offer – speak to customers and find out what they want. Using the same language as your potential customers use when they talk to you, will help boost conversions as your customers recognise that you know how to solve the problem they have.

- Implement Customer Relationship Management Software (CRM) to track your interactions with customers and send follow up emails or target them with special promotions.

- Optimise your sales page or conversion using software you can run what is called an A/B test which simply put means that half the visitors to your site see one version of your sales page (Version A) and half see a different version (Version B). As the test runs version a is constant pitted against version b. The version which converts the best becomes your version A and you then change something else (e.g. the colour of the buttons) and check the effect of that.

As W. Edwards Deming Said:

“Profit in business comes from repeat customers, customers that boast about your project or service, and that bring friends with them.”

And that is the best way to lower your customer acquisition cost over time.

If you enjoyed this post on calculating customer acquisition cost, then I’d be very grateful if you’d help to spread the word by emailing it to a friend, or sharing it on Twitter or Facebook using the links below. Thank you!